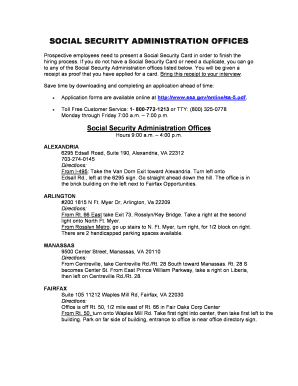

ES IRPF Modelo 145 2024-2025 free printable template

Show details

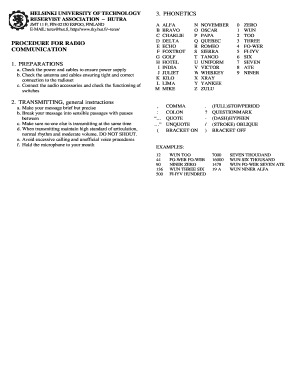

9 3 Impuesto sobre la Renta de las Personas FsicasComunicacin de datos al pagadorRellenar Formulario4 : ModeloRetenciones sobre rendimientos del trabajo145(artculo 88 del Reglamento del IRPF)Si prefiere

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign modelo 145 irpf form

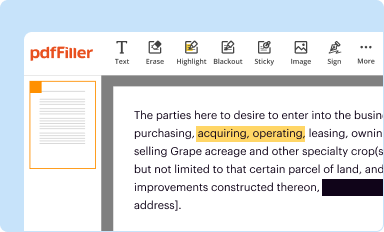

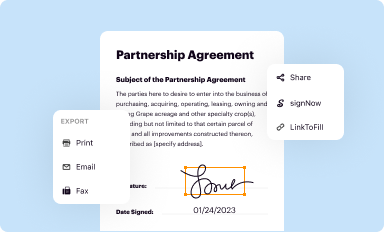

Edit your irpf rendimientos datos pagador form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

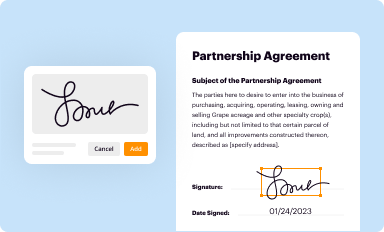

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your modelo 145 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit modelo 145 form online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Sign into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit modelo 145 retenciones form. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

It's easier to work with documents with pdfFiller than you could have believed. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

ES IRPF Modelo 145 Form Versions

Version

Form Popularity

Fillable & printabley

Fill

form impuesto renta personas fisicas rendimientos

: Try Risk Free

People Also Ask about modelo 145 pagador form

What is Modelo 145 Spain English?

Form 145 is a form from the Tax Agency related to Personal Income Tax (IRPF) through which the taxpayer informs his payer (normally his company) and his personal and family situation, which will determine the percentage of IRPF retention applied to his payroll.

Who needs to file a tax return in Spain?

All Spanish residents have to submit an annual tax declaration or pay income tax to the Tax Administration Agency (IRPF), based on the income they earned in the previous year. Right now, it's time to submit your tax declaration for 2021. But don't worry—you have three months before the first draft is due.

How do I pay my taxes in Spain?

Paying taxes in Spain can be done via the tax agency's website, mobile app, telephone, or in person. Since most people do it online, here's how you can file your electronic tax return: Select the relevant form (modelo) to file your tax return. To file your income tax return, you need Modelo 100.

What is Modelo 145?

The modelo 145 form is a Tax Agency form dedicated to personal income tax (IRPF) through which taxpayers inform their payer (normally, their employer) about their tax and family status, which is then used to define the income tax withholding percentage applied to their wages.

What happens if you don't pay taxes in Spain?

Failure to pay tax can result in penalties of between 50% and 150% of the tax owed, plus interest. Late payment can result in penalties between 5% to 20% of the tax involved, plus interest.

What is Modelo 210 in English?

Modelo 210 is the Spanish tax form for non-residents. It is valid for persons who do not live in Spain but own a property in Spain and need to declare property taxes for the Spanish home.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send form retenciones comunicacion to be eSigned by others?

Once you are ready to share your spanish modelo 145, you can easily send it to others and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail, or notarize it online. You can do all of this without ever leaving your account.

Can I create an electronic signature for the spanish modelo 145 form in Chrome?

You certainly can. You get not just a feature-rich PDF editor and fillable form builder with pdfFiller, but also a robust e-signature solution that you can add right to your Chrome browser. You may use our addon to produce a legally enforceable eSignature by typing, sketching, or photographing your signature with your webcam. Choose your preferred method and eSign your irpf pagador in minutes.

How do I edit modelo 145 retenciones comunicacion pagador fillable on an iOS device?

Create, modify, and share modelo 145 irpf comunicacion pagador using the pdfFiller iOS app. Easy to install from the Apple Store. You may sign up for a free trial and then purchase a membership.

Fill out your ES IRPF Modelo 145 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Modelo 145 Form Irpf Rendimientos Online is not the form you're looking for?Search for another form here.

Keywords relevant to es modelo 145 irpf comunicacion form

Related to irpf retenciones trabajo

If you believe that this page should be taken down, please follow our DMCA take down process

here

.